Denied or Dropped Coverage? How an Inspection Could Help Reinstate Your Policy

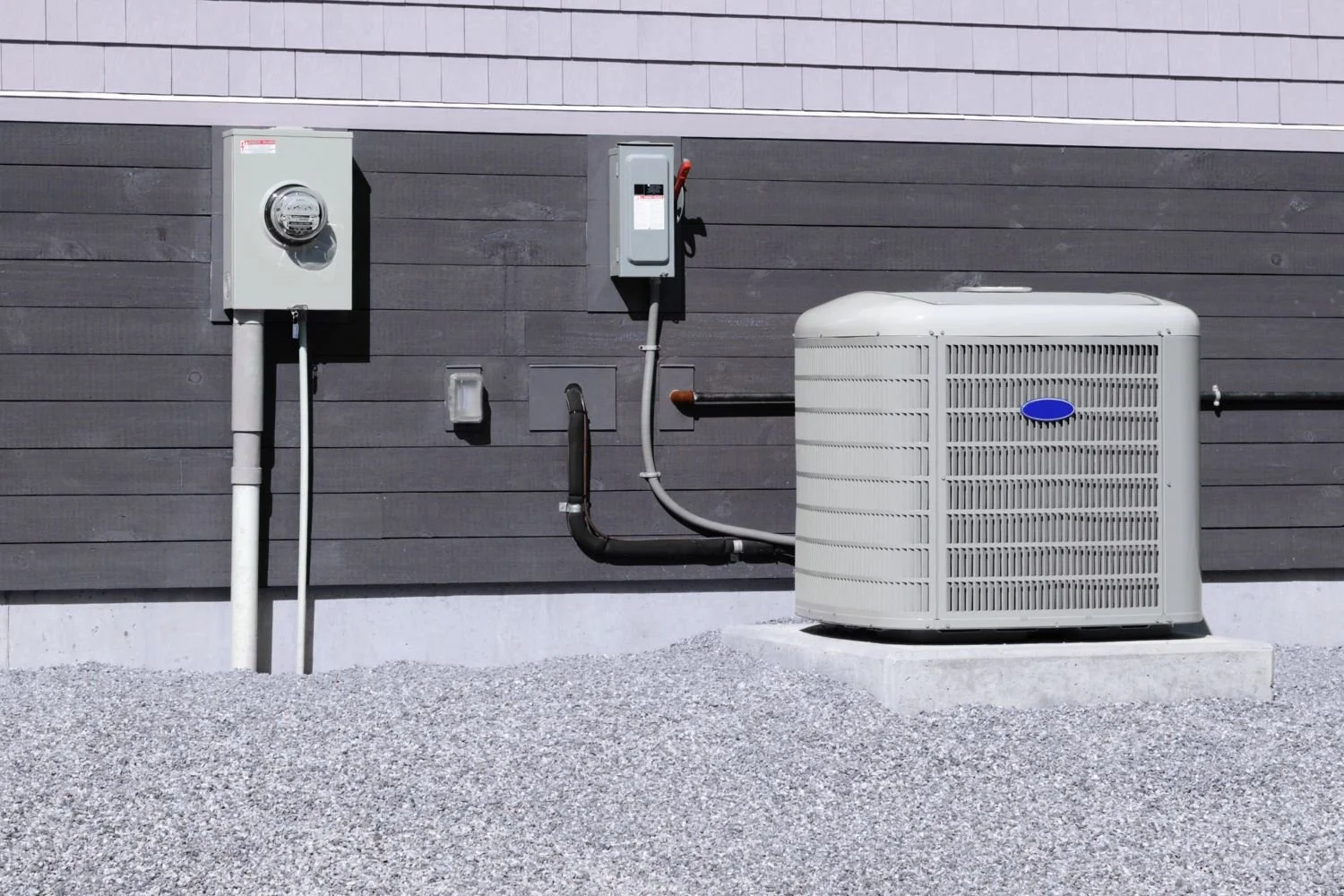

If your Florida homeowner’s insurance was denied, dropped, or not renewed, getting a new 4-Point Inspection or Wind Mitigation Inspection can often help you regain coverage or qualify with a different insurance carrier. Updated insurance inspections provide accurate, current documentation of your home’s roof, plumbing, electrical, HVAC, and wind-protection features, correcting outdated information, verifying completed repairs, and speeding up the approval or reinstatement process in Florida’s strict insurance market.

Why You Should Get a New Insurance Inspection After Replacing Your Water Heater

Replacing your water heater can help lower your Florida homeowner’s insurance premium, especially if your previous 4-Point Inspection listed outdated plumbing, an aging water heater, or conditions that no longer reflect your home’s true risk. Updating your 4-Point Inspection after the replacement provides insurers with accurate documentation, helps prevent coverage or renewal issues, and may qualify you for more insurance carrier options, discounts, and better rates across Florida’s tightening insurance market.

Common Issues Found During Insurance Inspections (and How to Fix Them)

Most Florida homeowners don’t realize how common problems like roof wear, outdated electrical panels, plumbing issues, or aging HVAC systems can affect insurance approval or premiums. This guide explains the most frequent issues found during 4-Point and Wind Mitigation inspections, and the simple fixes that help you stay covered or before an inspection.

The 7 Most Common Kitchen Plumbing Defects

Spot the most common kitchen plumbing defects, from dripping faucets to clogged drains, to keep your home functional and safe.